After more than 1300 trades, the 0DTE Breakeven Iron Condor remains my most profitable options trading strategy. This is what I have learned after more than one year of trading.

In January 2022 I wrote a blog post describing what has been my most profitable options trading strategy: The 0DTE Breakeven Iron Condor.

I received a massive response to this article, and many have asked how it did during the turbulent first half of 2002, with huge swings and the markets dropping.

So here is the summary:

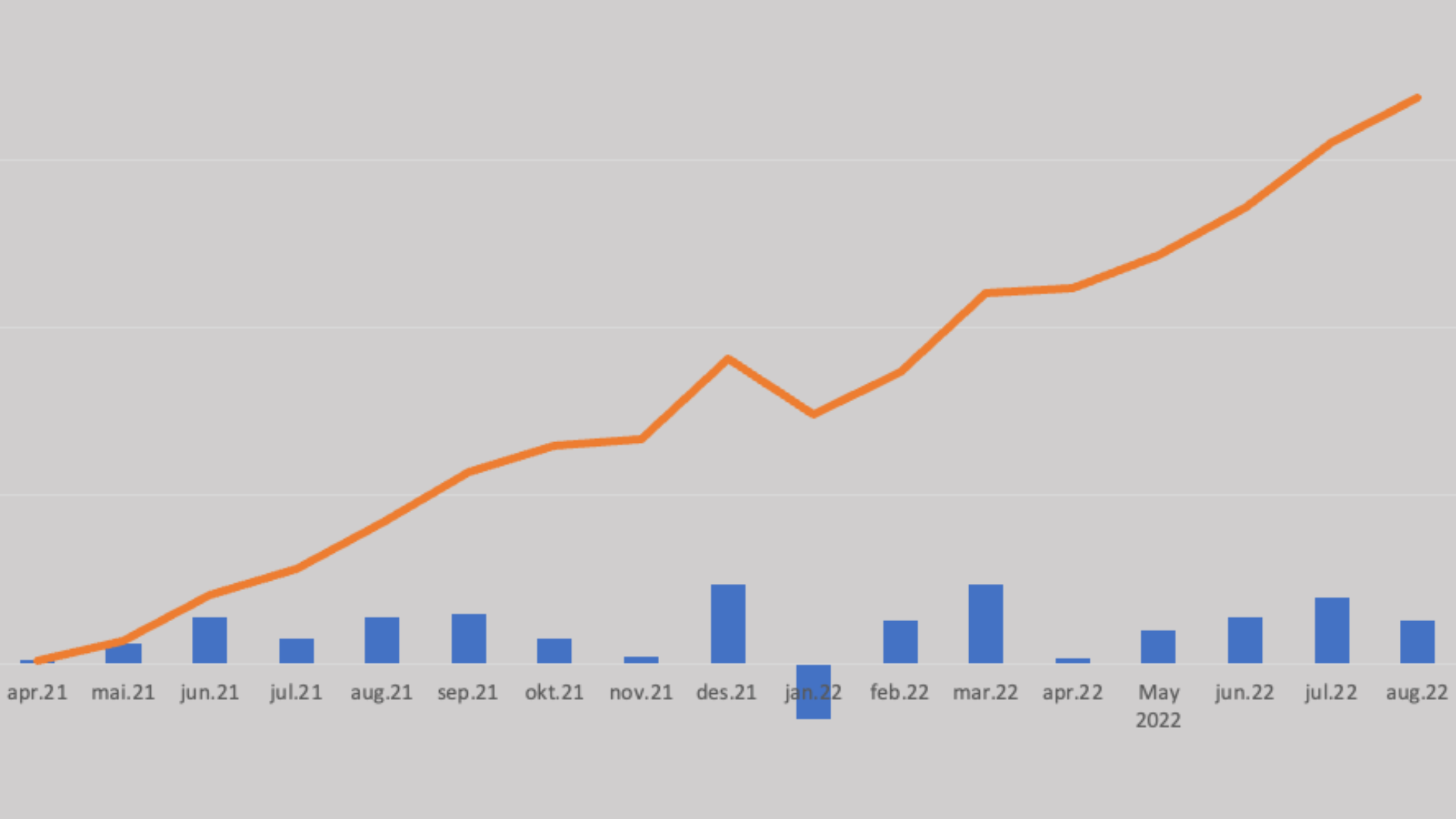

- After 16 months of trading – only one month (January 2022) has seen a loss.

- The strategy is showing an annual profit of more than 70 – 80 % as measured against the maximum buying power I am allowing myself to put at risk

- 38.3 % of the trades have been winners so far. That is a bit down from the 41.6 % I reported in January, and for sure a result of the turbulent first half-year of 2022.

This article is only to describe my own experience with this strategy, and should not be interpreted as financial advice in any way. Remember: Any options strategy carries great risk – and this particular strategy has the potential to blow out your account if you do not use stop losses or manage the risk well.

This is the 0DTE Breakeven Iron Condor strategy

Let us summarize the 0DTE Breakeven Iron Condor strategy before we move on.

- It is a day trading strategy on SPX – the index option for the S&P 500 index. 0DTE = Zero Days to Expiration.

- It consists of selling Iron Condors on SPX – with expiration the same day – collecting approximately the same premium on both sides. The Iron Condors are typically sold with a delta of 5 – 8. Usually, I collect a premium of 100 to 200 dollars. I typically set the wings between the shorts and the longs to 30 points. Usually I will do 5-6 such trades during the day, but rarely have more than 3-4 open at the same time.

- The trades have a very tight stop loss – set separately for each side equal to the total premium collected for the Iron Condor. This limits the potential loss on each trade.

Iron Condor: An options trading strategy where you sell both a call credit spread and a put credit spread at the same time. The trade profits if the underlying stays within a defined range when the options expire.

Read the original blog post for a more detailed description of the strategy.

The results so far

I started trading the strategy at the end of April 2021 – and have put on trades on most trading days since then. On most days I risk a maximum of 12 000 dollars in buying power. On some occasions, when I feel a couple of the positions are very safe, I might go up to 15 000 dollars. My individual trades are always only one contract.

- During the last year (August 2021 to July 2022) I made 12 681 dollars on this strategy (after commissions and fees). That is 84,5 % of the max buying power of 15 000 dollars I use. In total I have made 16.814 dollars on the strategy. NB: All numbers in this article are after commissions and fees.

- The average trade made 0.46 % of the capital at risk for that trade. That may seem little – but remember that the same capital is used again and again each day. (Annualized over 250 trading days it becomes 121 %)

- The premium capture rate has been 9 % – and the trade keeps having a positive expectancy.

- The average win is 2.4 times as big as the average loss.

What I have learned

These are some of my key learnings so far:

- This strategy can be consistently profitable – and is suitable for traders who do not like big drawdowns on their accounts.

- Although many parts of the strategy, such as the tight stop losses, are mechanical, the strategy requires quite a bit of flexibility in how it is executed.

- Risk management is alpha and omega for whether you have success with 0DTE Breakeven Iron Condor. Especially it is important to try to avoid double stop losses.

How I trade 0DTE Breakeven Iron Condors

My trading has evolved since I wrote the original article. Not least, I am even more focused on my total risk at any time.

- I usually put on the first trade around 5 – 10 minutes after the market has opened. I try to get around 200 dollars in premium for this one. The premium should be about the same on both the put side and the call side.

- Before I do anything else, I immediately set the stop loss for my trade. The market can move so fast, that it is essential to have this in place with no hesitation.

- Because of the volatility crush in the first hour of the market, this trade will sometimes get profitable very fast (or sometimes lose equally fast). If it has reached more than 50 % of its profit potential within the first hour, I will usually take it off to pocket money to pay for any later losses in the day.

- I will add new trades later – but there will always be at least 30 minutes between them. I do not have any strict rules for when I add trades. Rather I look at my total risk, and whether a new trade will balance it. For instance, if I already have two trades going against me with a high negative or positive delta, adding a neutral new Iron Condor might be a good idea. Likewise, if my active trades are already in solid positive territory, adding a new trade is safer.

- I will try to reduce risk as much as I can during the day. I do this in several ways. Sometimes I take off trades early to lock in some profit. Often I tighten stop losses to guarantee a profit if some trades are in positive territory. And if stop losses hit on one side, I will often close the other side as well once it can be closed for 5 or 10 dollars. This is again to reduce my total risk.

- I will never have more than 5 trades on at any time, usually only 2 – 3. Five simultaneous trades are reserved for situations when I have a great deal of control, for instance that 2-3 of them are already profitable and I have locked in a profit with my stop loss.

Read the original blog post for a more detailed description of the strategy.

My stop losses

Stop losses are crucial to this strategy. The market can change so fast and brutally intraday that I do not understand how anyone dares to do 0DTE trades without stop losses.

This strategy has very tight stop losses compared to most 0DTE strategies. The advantage of that is that you will rarely have very bad days. Most losses are around 25-30 dollars per contract.

MY STOP LOSS STRATEGY

I use a combination of stop limit and stop market orders on my stop losses. The stop losses are set separately on the call and the put side.

On each side I first set a stop limit order. The stop price for each side is the total premium I received for the full Iron Condor + 10 points. The limit price is typically set 15 points beyond that, sometimes 20. I set the stop orders on the spread, not only the shorts.

At additional 15 points further out from the limit price I set a stop market order using the OCO functionality (Once Cancels the Other). This serves as a last line of defence to make sure I do get out of the trade if the market moves so fast that the stop limit order is skipped. However, in almost all the cases it is the stop limit order that triggers.

Late in the day, when the longs have lost almost all their value, I will change the stop losses from being on the whole spread to only cover the shorts.

The biggest risk with this strategy

There is no doubt what is the biggest risk with the 0DTE Breakeven Iron Condor strategy: Double stop losses.

The 0DTE Breakeven Iron Condor assumes that only the stop loss on one side of the Iron Condor will hit. In that case, the loss per contract will be around 20 – 30 dollars, including slippage.

This is true in almost all cases. But every now and then the market suddenly moved in the opposite direction – and the stop loss is hit also on the other side.

How often does this happen?

Well, I can tell you exactly how often it has happened to me! After 1344 trades with this strategy, I have experienced a double stop loss in 3,8 % of my trades. This percentage has stayed quite consistent.

There are two other risks I want to point out with the two-layer stop loss strategy I follow :

- If the stop limit order is skipped and the stop market order is what triggers, I will now and then experience a rather bad fill, making the loss much bigger than normal.

- There is a theoretical chance – and it has happened to me two or three times – that both the stop limit order and stop market order will trigger simultaneously. In that situation, you will suddenly be long the position you were short. This does not need to be bad; if the market keeps moving against your original position, you can actually profit. But at least for me, it has taken a few minutes to understand what happened. And I really don’t like events that were not intended, even though they may be beneficial in the end.

The perfect day with this strategy

The worst day of the 0DTE Breakeven Iron Condor strategy is obviously if double stop losses hit on several of my trades. Then the losses can add up very quickly. This is why I try to take off my risks during the day when opportunities to do so offer themselves.

But what is the perfect day?

It is a day that starts with high volatility priced in, but very quickly develops into a completely flat day, leading to a consistent drop in volatility throughout the day.

On a day like that, you can pick money like fruit from an apple tree. Take off trades, enter new. Take off trades, enter new. Repeat and rinse.

Those days do not happen often. And when they do, you do not typically realize it before it is too late. That is trading!

Most days stick to my average after 16 months with the strategy: I lose 61,7 % of the trades and I win 38,3 %. And because my wins on average are 2.4 times the size of my average losses, the strategy keeps having a positive expectancy.

Expectancy

Win percentages do not really matter in trading. What really matters, is if you have a positive or negative expectancy.

Expectancy is measured in the following way:

Expectancy = (win rate * average size of wins) – (loss rate * average size of losses)

After 16 months and 1344 trades this strategy keeps having a clear positive expectancy. That makes me feel confident. So I will keep going!

My next step with this strategy

So if this strategy has been so successful for me after 16 months, why do I still only trade 1 contract at a time? Is it not time to “up the game”?

There are two answers to that:

- While this strategy has been consistently profitable, I have had losses on other strategies I did, especially weekly trades. So I have not had the capacity to scale it fully yet.

- As for 0DTE trades, I am currently exploring a path where I do four different 0DTE strategies on a single day, this being the “bread and butter”. My hypothesis is that this diversification will give better total results than only following one single strategy.

But most probably I will scale the 0DTE strategy very soon. And I believe that the way to scale is to add more contracts rather than doing more trades.

My first scaling step will be to do the first trade of the day with two contracts, and then take them off one at a time unless they hit a stop loss.

But most importantly: I love the fact that I have found a trading style that fits my personality – chasing the small daily wins without huge losses.

At the end of the day, how we trade has to fit our own personality and style.

Want to learn more about 0DTE options trading. Join the TastyTrade Options Facebook group. I have learned so much from the other members there.

Tkx for the write-up. Keep up the good work.

Thanks a lot!

Hi John. Do you enter the legs for the iron condor separately to ensure similar premium for your first trade?

Are you now doing this 5 days per week? I would expect the annual ROC would be even higher with 5 daily expirations per week.

I am doing it most days, except when work or private obligations stop me from trading 🙂

great write-up!

Can you explain how you trade the 0DTE all 5 days per week? I thought the SPX options are only on Monday, Wednesday, and Friday.

Thank you Ryan! Actually the SPX options were opened for trading every day a few months ago 🙂 So now you can trade 0DTE on Tuesdays and Thursdays as well! It makes a difference!

Can you provide some examples of your recent trades using IC strategy? Appreciate if u could email me.

Thanks

Hi John,

Great article!

Would using short strangles instead of iron condors increase the percentage of profitable trades? Since you have stop losses for each trade?

Hi John,

Great article. I just want to bring to your attention that there is a typo “2002” which I think you meant “2022”.

John Einar Sandvand very happy to see your gains( particularly it is challenging in these markets) I have read your blog, i am newbie, I am a bit shaky about TP and SL.I have few questions please share your thoughts

1. How does this strategy fare if you have time to do only 1 or 2 trades a day?

2. The SL and the over loss is a bit confusing to me. If your SL is on the premium of full IC for ex if your ic premium is 2 $ and (each side being 1$) when you are stopped on one side your loss would be 2$ and net profit would be -1$ isn’t it? How are you getting net loss of 20-30c?!?

Hi Santosh! As for question 1: The way I trade the strategy is to spread trades out throughout the day. In that way I enter on different levels. I often do 8 – 10 trades in a day. That being said: I expect you will reach the same results with 1-2 trades – but you will have to look at much longer periods to see the similar statistics. As for question 2: To use your example. I have already collected 2 dollars. So if I am stopped out on one side, it means my gain is zero (200 dollars premium collected minus the 200 dollars lost on the stop loss). On top of that comes the slippage, which typically is in the 20 – 30 dollar area.

I do not understand this, as your PL day for that single strategy will show -1 if you carry to expiration. Yes you collected two but having a stop loss at -2 means your pl day is -1. I dont get it.

Hi John,

Congratulations on your success with this approach. I was very excited to come across your blog as I have been refining a similar approach over the last 6 months. My SL’s are not as tight as yours, but I have some success locating the sweet spot between the expectancy and the rate of being stopped out, though, of course, it changes from day to day.

After some poor fills on SL’s based on spread price, I have moved to setting market sell orders on the spreads based on a quote trigger. I estimate the quote value by using optionstrat to see roughly where SPX will have to be for me to experience, say, a 100% loss on the entire position within the next hour. Since optionstrat is modeling option values (presumably using Black-Scholes), it’s not a precise way to close at a particular option value, but the executions are fast and reliable. I believe the uncertainty around spread value at a given future value of SPX is no worse than the noise in setting stops based on option price.

Curious to get your thoughts on this approach to setting SL’s. If it intrigues you at all, I have a followup question for you regarding how to determine short strikes to sell (rather than using delta).

Best,

Byron

Hi Byron! To be honest, I struggle to wrap my head around exactly what you do in your stop loss strategy. That being said, I think the most important is to be consistent in your slected strategy and log all trades. Only then you can analyze it in a proper way. As for me, I have chosen a very tight stop loss. Yes, in most cases the stop loss triggers, the trade would have been a win in the end. But it gives me peace at mind – I rarely have days with big losses.

im new to IC.. so im confused about the setup. (trying this on papertrade).

You wrote:

The Iron Condors are typically sold with a delta of 5 – 8. Usually, I collect a premium of 100 to 200 dollars. I typically set the wings between the shorts and the longs to 30 points.

Today’s SPX price is 4055…

Are these strikes correct? https://i.postimg.cc/2yNy8MCS/image.png

How do you ensure that your stop-limit order and stop market order ALL get filled at once with your IC?

would be nice if you can show a screenshot of how the orders are placed

3) Do you do any adjustment throughout the day?

4) Do you close the early to take profit? if so, is it manual ?

Great write up. I’ve been doing something very similar for about 4 months now. I will probably take some of your method and add it to mine. Thanks a lot.

Thanks John.. so you manually take the profit instead of putting a limit order to take?

Great write up, John!

One thing to consider…. Drop the wings.

I know, surprise! I’m crazy! But in all seriousness you are making money because of the VRP (Variance Risk Premium) that’s it. Simple as that. Your edge is in the implied > realized vol, why ruin that with wings? That’s crazy. You already have stops.

In addition I’d move your stop up to 2x because you need to allow more wiggle room.

Lastly, I would not trade this in a high volatility environment; where RV > IV.

Other then that major flaw of the wings. I love the data and the trades. Thank you.

Hi John. I agree with Gavin on the dropping of the wings and would appreciate to hear your view. What do you think of using trailing stop losses? Then you can leave a position to run on is own and cash in when the situation is right.